09 December 2022

How to Save Money on Your Car Insurance?

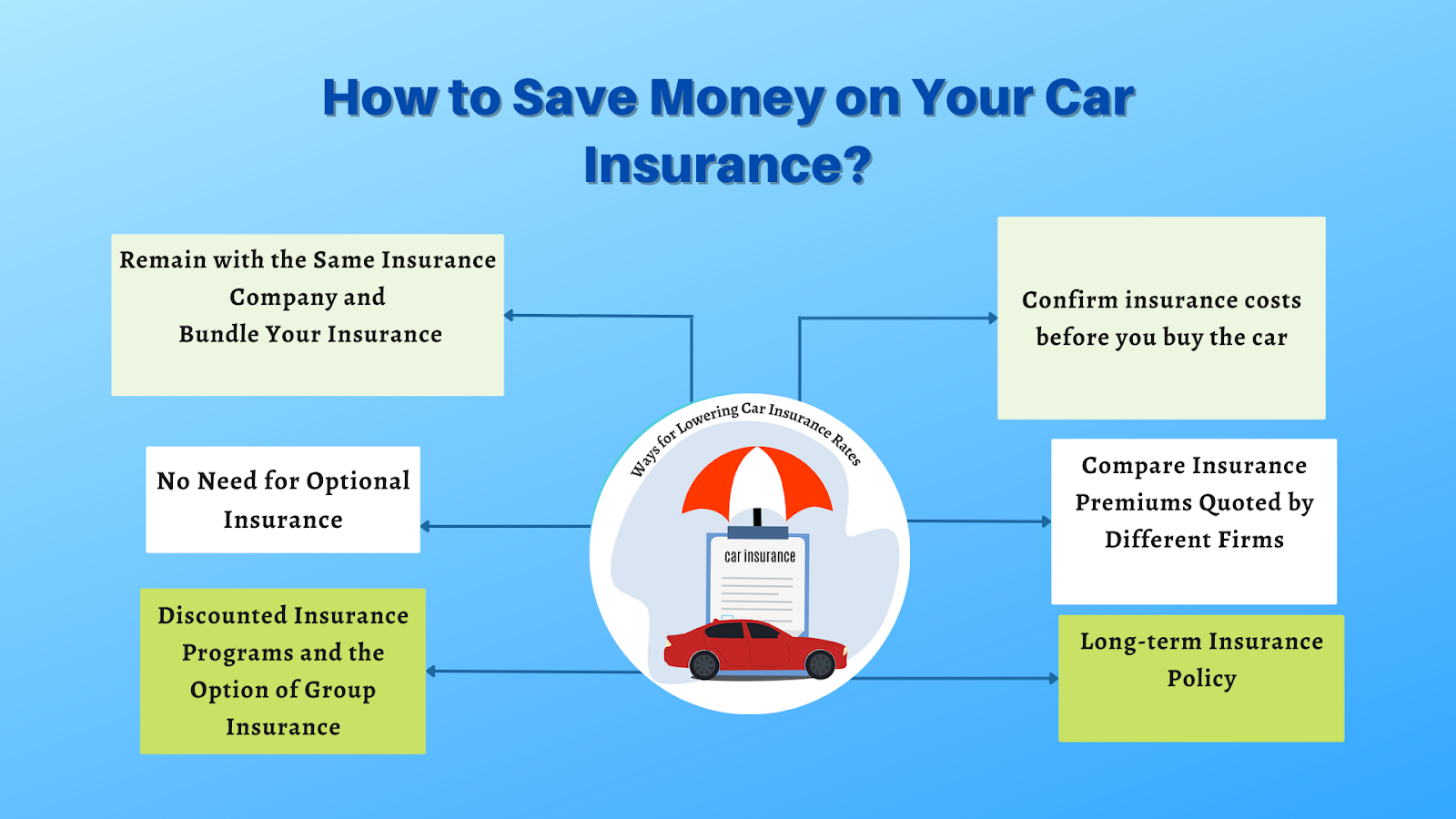

Ways for Lowering Car Insurance Rates

Here we are looking into some of the ways for saving money on car insurance.

1. Confirm insurance costs before you buy the car

Whether you are buying a used car or a new one, the insurance premium would depend on the cost of the car. The insurance charges on pre-owned cars would be relatively lower owing to the price depreciation. Even then a luxury sedan second-hand car’s premium would be much higher than that of a normal hatchback and so on.

Insurance companies evaluate the car’s price, the spare costs, and the overall expenditure they might have to spend whilst determining the premium. Many companies are ready to offer better deals if the car has features for theft prevention, safety components for reduced personal injuries in case of an accident, etc. You have the option to discuss the approx. insurance premiums with the executives at the used car dealerships. They might be able to guide you in this regard as they have experience in the field.

Read to Know: Can You Sell A Car Without Insurance in India?

2. Compare Insurance Premiums Quoted by Different Firms

There are a lot of benefits to understanding how to save money on your car insurance. The car insurance sector is a highly competitive field, similar to any other business field. Insurance companies try every way possible to get the customer on board. Reduced insurance premium has been the most effective hook they use. With several insurance firms vying for customers, you have the option to ask for quotations from them and compare.

The vehicle insurance premium differs from company to company. Furthermore, the entry of third-party players like PayTM, PhonePe, etc. as intermediaries or insurance agents has escalated the competition further. By using their services you might get more discounts and significantly low-priced car insurance.

3. Remain with the Same Insurance Company and Bundle Your Insurance

If you are not aware of how to save money on your car insurance may switch to diffrent insurance companies every time. Insurance companies are on the constant lookout for permanent customers. They offer lucrative deals for the customers to remain committed to them. This is another way to cut down on car insurance costs. Many a time, people do not realize this factor. They jump from one insurance company to another expecting a better deal. You might be losing money and a chance to get discounted car insurance by this.

Bundling the insurance is also a viable and financially beneficial option. Suppose you have more than insurance like car insurance, home insurance, and personal insurance. Clubbing it together and obtaining it from the same insurance company would be economical. As they are getting more than one insurance from the same client, the insurance firms are not going to let you go. They would present you with an exclusive deal.

4. No Need for Optional Insurance

Optional insurance may not be required, especially if you are buying a used car. The insurance coverage may not be sufficient to cover the expenditure, since the car is already in a depreciated value. For more info, you might have a detailed discussion on this with knowledgeable executives at Indus Used Cars.

Similar to the aforesaid, over-insuring also is not beneficial. You would be paying a higher insurance premium than normal, without any useful results. Picking only the mandatory coverage would be more advantageous for you. The case is the same if your car is old enough.

5. Discounted Insurance Programs and the Option of Group Insurance

Group insurance or insurance to employees from specific sectors or organizations is an economical option. Many insurance firms provide special discounts for groups like central government employees, personnel from the defense sector, bankers, and so on. Do not hesitate in discussing this possibility with the company.

Discounted insurance programs for the employees would be available on special occasions might also be available. Talk to the insurance agent or at the company office directly, to confirm whether any such deals are available.

6. Long-term Insurance Policy

People normally go for annual insurance. The budgetary limitation might be the reason behind this for most. Nonetheless, it is budget-friendly if you are buying long-term car insurance. The firms offer better discounts and reduced insurance premiums if the vehicle insurance is for multiple years.

Adding to the above point, missing insurance renewal might become costly. You will have to pay hefty fines if the RTO authorities find the insurance is not valid. Moreover, the insurance companies will undertake a detailed inspection prior to renewing expired insurance. It is an intricate process and you need to pay the inspection charges as well.

Indus Used Cars – Your One-stop Shop for Buying a Pre-owned Car

Indus extends optimal support to customers for everything related to second-hand cars. From buying the used car at an affordable price to insuring it with a reasonably-priced premium, we would support you at every step.

Having an extensive collection of multi-brand used cars in Kerala, we offer you the option to compare multiple models and pick the right one. Our team would brief you on every aspect related to the car model of your choice. Helping you in determining the second-hand car to buy.

To learn more about how to save money on your car insurance, Visit us today or connect with us via phone, we are at your service.

Also Read, How often do you change your car